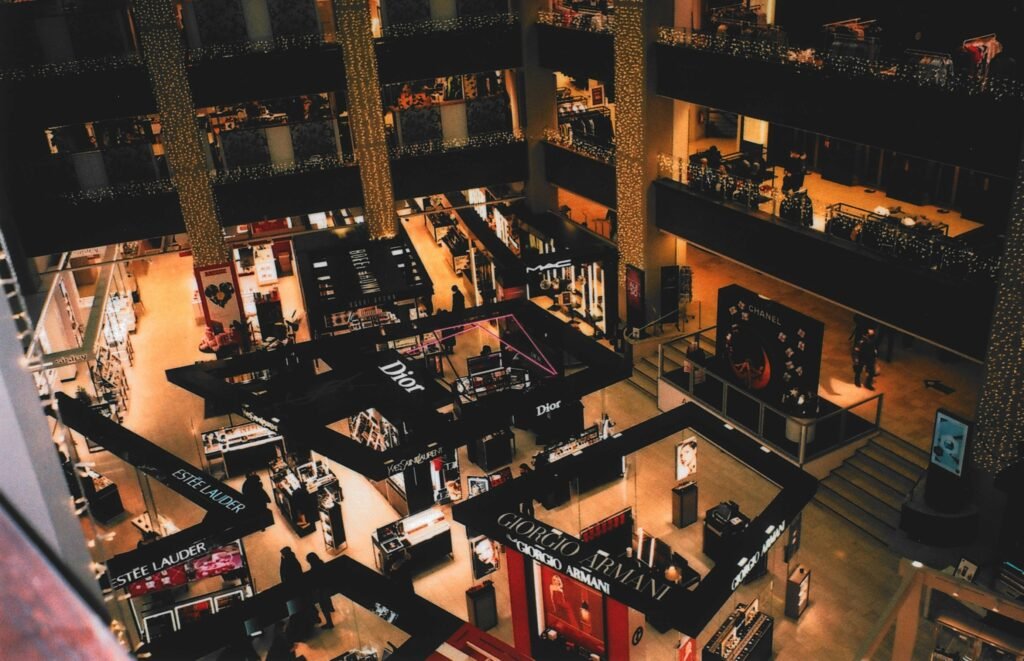

Insurance For E-commerce and online retailers

Insurance for E-Commerce and Online Retailers in California

Running an e-commerce business in California comes with unique challenges — from managing digital transactions to ensuring customer satisfaction in a competitive online market. As an online retailer, you handle inventory, process payments, and ship products across the state and beyond. Each of these operations carries potential risks that could impact your finances and reputation. That’s where insurance for e-commerce and online retailers becomes crucial.

Whether you sell clothing, electronics, handmade goods, or specialty products, your digital storefront faces exposure to cyber threats, shipping losses, and liability claims. Having a comprehensive insurance plan designed specifically for your online business ensures that these risks don’t disrupt your operations. With California’s booming e-commerce industry, protecting your assets and digital infrastructure is a smart investment for long-term success.

Beyond product protection, insurance coverage helps build customer trust. Many consumers prefer shopping with online stores that demonstrate professionalism and preparedness, including adequate insurance protection. In the fast-paced digital economy, even a small mishap—like a product defect or delayed delivery—can lead to costly legal actions or refund demands. Insurance helps you navigate these situations confidently and focus on growth.

Learn Way to Insurance

How We Works

01

Choose Your Retail Insurance

Select the right retail business insurance plan tailored to protect your store, employees, and inventory in California.

02

Schedule a Consultation

Book a quick consultation with our California insurance experts to review your retail business coverage needs.

03

Meet With Your Dedicated Team

Our experienced retail insurance agents will help you understand every coverage option and create a custom plan.

04

Get Your Insurance Policy

Secure your retail store insurance policy and operate confidently knowing your business is fully protected.

General Liability Insurance for E-Commerce and Online Retailers

General Liability Insurance is essential for every e-commerce and online retail business in California. This policy covers common risks such as third-party bodily injury, property damage, and personal injury claims. Even though your business operates primarily online, liability can arise from product-related issues, marketing materials, or accidental data exposure. General liability insurance ensures that such claims don’t harm your business financially.

In the e-commerce landscape, product liability is one of the most significant concerns. If a customer claims that an item purchased from your website caused harm or damage, your business could face legal action. General liability insurance helps cover legal fees, settlements, and judgments, ensuring your business reputation remains intact.

Additionally, this insurance can protect your business against advertising or copyright claims. For example, if a competitor accuses you of using their images or slogans, your policy can handle the legal costs. It provides the foundational protection every online retailer needs to maintain stability and customer confidence.

Investing in general liability insurance for e-commerce businesses is more than a precaution—it’s a strategic decision that allows you to operate confidently in California’s digital marketplace. Safeguard your business today with General Liability Insurance in California

RETAIL BUSINESS INSURANCE

Business Owner’s Policy for E-Commerce and Online Retailers

A Business Owner’s Policy (BOP) combines essential coverages—general liability and commercial property insurance—into one affordable package tailored for small to medium-sized online businesses. For e-commerce companies in California, this means comprehensive protection against both physical and digital risks.

With a BOP, your inventory, equipment, and technology are covered in the event of theft, fire, or damage. This is particularly valuable if you store products in a warehouse or use computers to manage your website and orders. The policy also includes liability coverage for third-party claims, offering balanced protection for the hybrid nature of online retail operations.

Cyber threats are another major concern for e-commerce businesses. A customized BOP can include cyber liability protection, safeguarding your business against data breaches and digital fraud. As California enforces strict data privacy laws, such coverage helps ensure compliance while minimizing downtime and loss.

A business owner’s policy for online retailers gives entrepreneurs peace of mind and financial resilience, allowing them to focus on growth without worrying about unexpected disruptions. Learn more about tailored BOP options at Business Owner’s Policy Insurance in California

Let’s Protect Your business, life and much more.

INSURANCE

Workers’ Compensation Insurance for E-Commerce and Online Retailers

If your e-commerce business has employees in California, Workers’ Compensation Insurance is a legal requirement. It protects both your business and your staff by covering medical expenses and lost wages in case of work-related injuries or illnesses. Even in an online setting, workers can face risks like repetitive strain injuries, warehouse accidents, or shipping-related mishaps.

For e-commerce entrepreneurs managing fulfillment centers or logistics teams, workers’ comp ensures that employee injuries are handled responsibly and without financial strain on the company. This builds employee trust and compliance with California’s strict labor regulations.

Remote employees are also part of the modern e-commerce ecosystem. Whether they handle customer service or digital marketing, workers’ compensation provides coverage if they suffer injuries during work-related activities. Having this policy demonstrates professionalism and care for your team’s well-being.

In a competitive market like California, ensuring your business meets all legal and ethical standards enhances credibility and sustainability. Secure your coverage through Workers’ Compensation Insurance in California

FAQ

Frequently Ask Questions

Insurance protects e-commerce businesses from product liability claims, data breaches, shipping damages, and customer disputes that could otherwise cause major financial losses.

Yes. Even without a storefront, online retailers can face lawsuits related to products, advertising, or online transactions.

A Business Owner’s Policy (BOP) is typically the most comprehensive, combining liability and property protection for affordable coverage.

Yes, if you have employees in California. It covers workplace injuries and illnesses, ensuring legal compliance and employee safety.

Absolutely. Many insurers offer optional cyber protection as part of a Business Owner’s Policy to protect digital assets.

Your general liability insurance would cover legal fees, settlements, and other related expenses.