Insurance For Hardware stores

Insurance for Hardware Stores in California

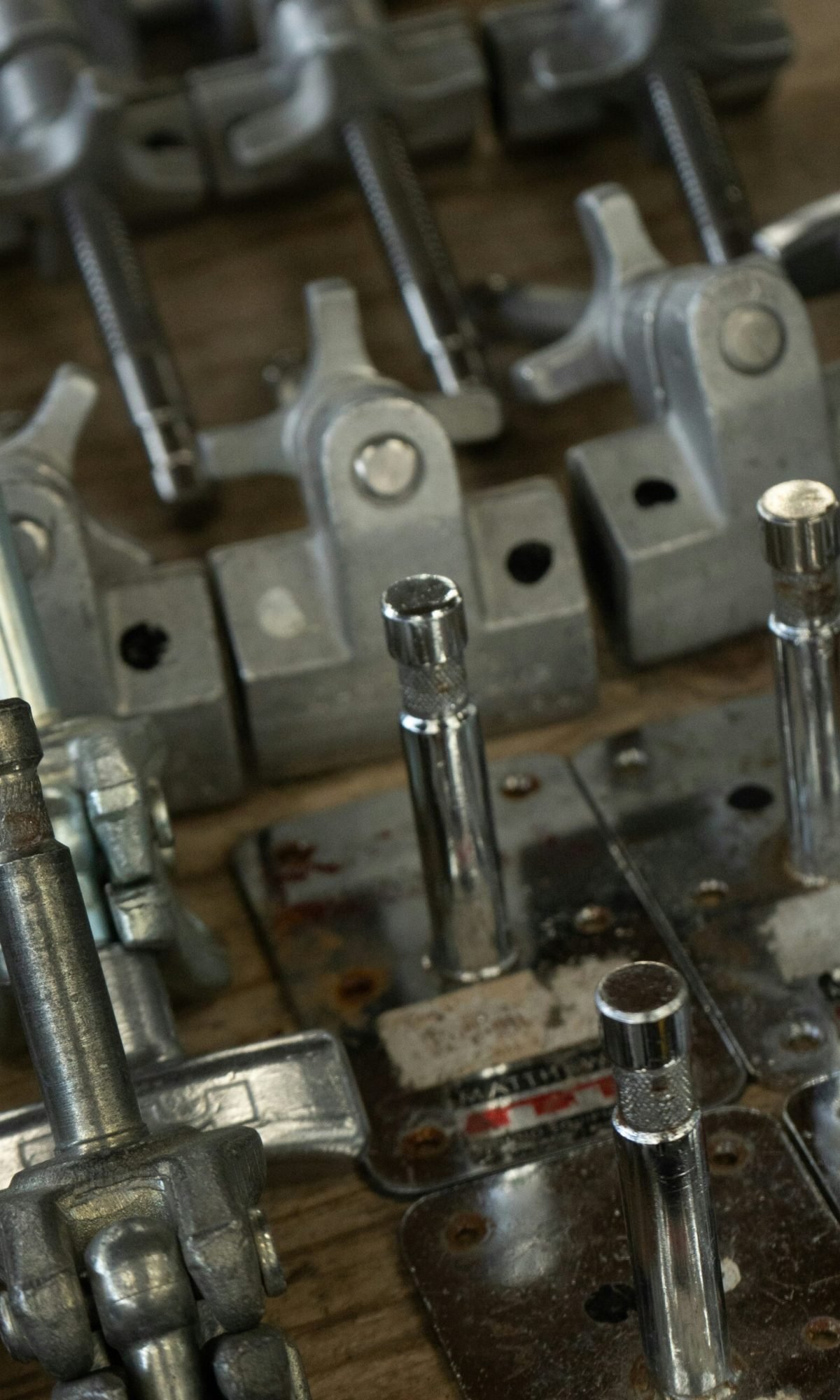

Owning a hardware store in California comes with its own unique set of challenges and responsibilities. From managing heavy inventory and expensive tools to serving a constant flow of customers, every day brings potential risks. Having the right insurance for hardware stores in California ensures that your business stays protected from accidents, property damage, or employee injuries that can lead to costly setbacks.

Hardware stores are dynamic spaces filled with valuable equipment, machinery, and flammable materials. A single spark, a misplaced tool, or a wet floor can lead to serious incidents. Without adequate coverage, you could face financial loss, legal claims, or business interruptions that impact your long-term success. That’s why investing in a reliable hardware store insurance policy is essential for safeguarding your operations.

In California’s competitive retail environment, hardware store owners face strict safety standards and growing liability exposures. Whether your store is independent or part of a franchise, insurance provides peace of mind knowing that your property, employees, and customers are covered against unforeseen events.

With customized hardware store insurance, you can focus on providing tools, materials, and excellent customer service — while your policy protects everything you’ve built. Comprehensive coverage ensures your business remains resilient and financially stable, even during unexpected challenges.

Learn Way to Insurance

How We Works

01

Choose Your Retail Insurance

Select the right retail business insurance plan tailored to protect your store, employees, and inventory in California.

02

Schedule a Consultation

Book a quick consultation with our California insurance experts to review your retail business coverage needs.

03

Meet With Your Dedicated Team

Our experienced retail insurance agents will help you understand every coverage option and create a custom plan.

04

Get Your Insurance Policy

Secure your retail store insurance policy and operate confidently knowing your business is fully protected.

General Liability Insurance for Hardware Stores

A key foundation of any hardware store insurance policy is General Liability Insurance. This coverage protects your store from claims involving third-party injuries, property damage, or advertising disputes. Hardware stores are busy environments, and even the most careful safety measures can’t prevent every accident.

If a customer slips on an oil spill, gets injured by falling merchandise, or claims that a defective product caused damage, general liability insurance can help cover medical bills, legal fees, and settlements. This coverage acts as a financial shield against lawsuits that could otherwise strain your business.

Product liability is another crucial protection under this policy. Many hardware stores sell power tools, electrical components, or hazardous materials that could potentially cause harm. General liability coverage ensures your business can respond to such incidents without devastating financial consequences.

Protect your hardware store from everyday risks with a strong liability plan. Learn more about general liability coverage through General Liability Insurance in California

RETAIL BUSINESS INSURANCE

Business Owner’s Policy for Hardware Stores

A Business Owner’s Policy (BOP) offers a complete coverage solution for California hardware stores by combining general liability and commercial property insurance in one affordable package. This policy protects your physical assets and helps you recover from disruptions caused by unexpected incidents.

Your hardware store likely holds valuable stock such as tools, machinery, and building materials — all of which can be costly to replace if damaged by fire, theft, or vandalism. A BOP provides financial coverage for repairing or replacing inventory and property, so you can get back to business quickly.

In addition to property protection, this policy also includes coverage for business interruption. If your store needs to close temporarily after a covered loss, your BOP can compensate for lost income and operating expenses, allowing your business to recover without major financial strain.

A BOP for hardware stores in California is essential for maintaining stability in a competitive market. It offers comprehensive coverage at an affordable rate, ensuring your store stays protected against the unexpected. Get complete coverage with a Business Owner’s Policy through Business Owner’s Policy Insurance in California

Let’s Protect Your business, life and much more.

INSURANCE

Workers’ Compensation Insurance for Hardware Stores

For hardware store owners in California, Workers’ Compensation Insurance (WC) is not just a smart choice — it’s required by law. This coverage provides protection for employees who suffer work-related injuries or illnesses, covering their medical expenses, lost wages, and rehabilitation costs.

Hardware store employees handle heavy tools, sharp objects, and machinery daily, which increases the risk of on-the-job injuries. Accidents like lifting injuries, cuts, or slips can occur at any time. With WC coverage, your employees receive the care they need while your business avoids penalties or costly lawsuits for non-compliance.

Beyond compliance, workers’ compensation insurance for hardware stores promotes safety and trust within your team. It reassures your staff that they are supported in case of an accident, improving morale and retention.

Protect your team and your business with a customized WC policy designed for California retailers. Explore your options through Workers’ Compensation Insurance in California

FAQ

Frequently Ask Questions

Because hardware stores deal with heavy equipment, flammable materials, and high customer traffic, having insurance protects against financial loss from accidents, property damage, or lawsuits.

It covers customer injuries, third-party property damage, and product-related claims that occur on your premises or as a result of your business operations.

A BOP combines property and liability coverage, protecting your assets from fire, theft, and business interruptions, making it ideal for small to mid-sized stores.

WC insurance covers medical expenses and lost wages for employees injured while stocking, operating tools, or handling deliveries.

Yes. Workers’ compensation is legally required for businesses with employees, and liability coverage is strongly recommended to protect against lawsuits.

Yes. Property coverage within your BOP protects inventory, tools, and fixtures against losses caused by theft or vandalism.